Several different terms—market economy, private enterprise economy, free market economy, and capitalist economy—are used to describe a market economy. For this section, they all mean essentially the same thing.

The theories and ideals associated with classical liberalism provided much of the foundation for the economic growth and technological advances that characterized the Industrial Revolution. As you have also learned, however, a significant portion of the population saw little benefit from these advances.

The social and political movements that arose in response to liberalism in Britain continued to evolve in the nineteenth and early twentieth centuries. As the Industrial Revolution took hold in the United States, pressure to address the inequities caused by capitalism also increased there as well.

While moderate steps were taken to address such inequities in many liberal democracies, the basic ideals of individualism and laissez-faire economics would continue to dominate in the industrialized world until the end of the 1920s. A cataclysmic economic event at the end of that decade, The Great Depression, called into question the economic theories of classical liberals thinkers. The result would be a new approach to liberal economics that would give the government a far larger role in economics.

In this lesson, you will address the question: How have market economies embraced liberalism?

The economy of the United States began as a model market economy. The government did not offer any services or help to the people of the United States. The only government intervention was in creating laws that protected workers and improved working conditions. Economic decisions were left to entrepreneurs and consumers through the selling and buying of goods and services.

Some entrepreneurs did better than others. John D. Rockefeller was one such entrepreneur. He started his career as a bookkeeper. In 1859, at the age of 21, Rockefeller and a friend bought an oil refinery.

Rockefeller’s quest for control of the refinery business grew. By 1874, Rockefeller controlled 22 of the 26 refineries in Cleveland. By owning and controlling so much of the oil refining process in Cleveland, Rockefeller is said to have created a monopoly over the refining of oil. When there is little to no competition, entrepreneurs can establish the price of a product and dramatically increase the cost of the goods to consumers.

The antitrust law ensures that entrepreneurs have an opportunity to compete with one another.

Since the United States followed the ideas of Adam Smith and a free market economy, the U.S. government did not stop this monopoly on oil refineries. Some have wondered what would have happened if Rockefeller had owned all of the oil refineries in the United States. Rockefeller could have set the price of oil as high as he wanted.

If Rockefeller owned all of the refineries, the price of oil would not have been set according to the principle of the invisible hand; rather, one entrepreneur would have set the price. To prevent such a situation from happening, the American government intervened and created the antitrust law.

The antitrust law prevents one person or company from controlling an entire industry. The law protects the interest of consumers by guaranteeing entrepreneurs the opportunity to compete and keep prices low for consumers.

This law goes against the general theory that the American government will not intervene in the economy. It was determined that to guarantee the survival of a free and open market, laws must be created to protect entrepreneurs. Otherwise, large corporations could take over smaller companies. The antitrust law gives every entrepreneur a fair chance to compete and succeed.

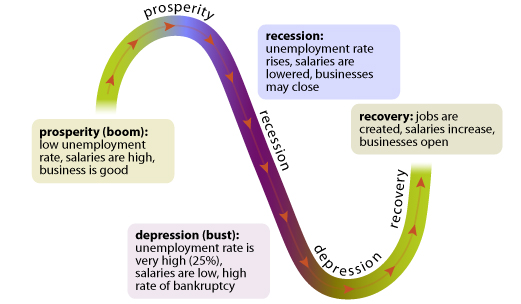

As with all things in life, economies experience highs and lows. This fluctuation is known as the boom-and-bust stage of the economic cycle. When the economy suffers a sharp drop, the country can fall into a depression. When there is full employment, the country experiences a period of prosperity.

Governments must learn how to deal with sudden increases or drops in the economy. You will now look at some historic examples of fluctuations in the economic cycle and how the government reacted.

The 1920s were known as the Roaring ’20s. Entrepreneurs were doing well. People were buying cars, and inventions like zippers, radios, self-winding watches, electric shavers, bubble gum, silent movies, and penicillin had found their way into the marketplace. The economy was booming.

The boom in the economy happened for several reasons. Businesses were doing well, sales were increasing, there was an increase in consumer goods, people were investing in companies, and profits were on the rise. Entrepreneurs had the capital needed to create new products. Entrepreneurs were able to borrow money they needed and didn’t have from banks, friends, and other investors. Money was flowing freely.

Think of the economy like a balloon. The air being blown in is like the money being injected into the economy. As deals are made and money is promised to suppliers and manufacturers, more air enters the balloon. If too much money is promised and not enough is paid, the balloon becomes weak and explodes, or busts. The Roaring ’20s boom came to an end in the 1930s when the economy went bust.

There were many reasons for the economic collapse. Some investors, who had promised money to aspiring entrepreneurs, did not meet their obligations. The entrepreneurs who had been promised money had made deals to create or buy goods from suppliers. When this money did not come, the entrepreneurs’ businesses failed. The broken promises trickled down and caused the suppliers’ businesses to fail too.

By May 1930, auto sales were declining. True to the principles of supply and demand, as sales declined, the price of vehicles also went down. To make economic matters worse, wages stayed the same. It was very difficult for entrepreneurs to make money selling fewer products for less money without reducing wages. As a result, workers were let go to reduce costs. The unemployment rate rose to 25 percent. Imagine one out of every four people unable to find a job.

Banks were closed for 100 days. No one could get a bank loan, cash cheques, or get money from bank accounts. People were unable to buy goods or services because they did not have access to money. Money was not flowing.

People living in rural areas also felt the effects of the downturn in the economy. The price of farm products fell, and drought hit the countryside. The term dustbowl originates from the 1930s. The earth was so dry that topsoil was blowing off of farmers’ fields. As the once-fertile lands became useless, it became impossible to grow crops. Because nothing could grow, the land was not planted and fields looked like barren fields of dust.

Farmers were forced off their farms and went to the city where they hoped to find work. With unemployment at 25 percent, there was no work to be found. Many entrepreneurs who had prospered during the Roaring ’20s lost everything and were left penniless. This bust period lasted almost a decade and is referred to as the Great Depression.

To try and get the economy moving, banks began lending money at a low-interest rate to anyone who had a new business idea. Something had to be done to stimulate the economy. Some began to wonder if the government should come to the rescue and help those who had lost their jobs.

Economists had different points of view on how to deal with an economic crisis like the Great Depression.

Confidence in the economy and the government was extremely low. Something had to be done to increase employment, consumer spending, and confidence in the economy.

The free market economy of the United States was in trouble. Poverty, monopolies, unemployment, and the Great Depression made the American people believe it was time to move away from a hands-off government policy. The American people needed help.

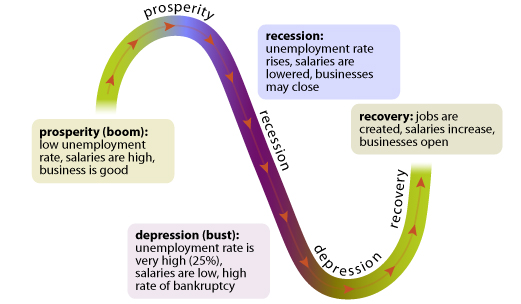

Franklin D. Roosevelt became the president of the United States in 1932. He believed in the new ideas of modern liberalists. The government must help the people of the United States in their time of need. Roosevelt felt that the only way to get the country out of the depression was to introduce government spending.

Roosevelt wanted to stimulate the economy by creating jobs. When people work, they spend money, which creates more jobs. To implement these policies, the American government had to go into debt and spend money it did not have.

Some of the jobs created and funded by the New Deal were silly: people were hired to research the history of the safety pin, to walk the streets of Washington, D.C. with balloons to scare birds, and to chase tumbleweeds on windy days. It seemed that any job was a good job.

The New Deal did not follow any of Adam Smith’s capitalist ideals. However, the people of the United States demanded government action. Roosevelt was concerned for the welfare of the people of his country. People saw that the government of the United States was leading its people in the right direction.

Not everyone approved of Roosevelt’s actions. Some people, following the principles of classical liberalism, believed that the government had no right to interfere in the economy. They continued to believe that, if left alone, the country would get itself out of the economic crisis.

Some Americans believed that Roosevelt’s ideas were communist, and they were afraid that their country was heading down the wrong path. However, the majority of people, the modern liberalists, supported Roosevelt and his New Deal. Modern liberalists believed it was the government’s duty to intervene and help the people affected by the economic crisis.

Ronald Reagan was president of the United States for most of the 1980s. The 1980s was another period of economic instability. The American debt was large and President Reagan wanted to see the debt lowered.

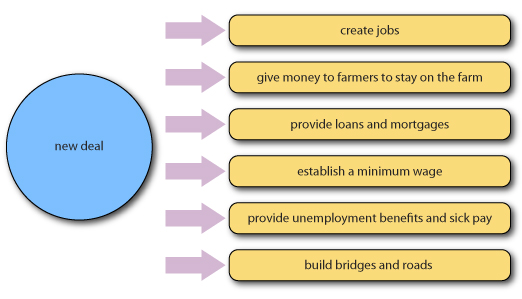

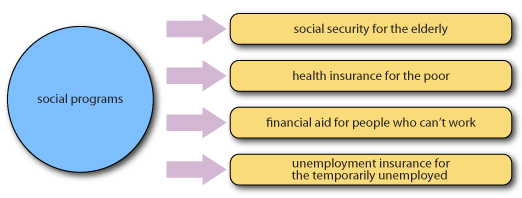

Reagan did not believe it was the government’s responsibility to provide social programs. He believed that if the government reduced spending on programs that created jobs or assistance, taxes would be lower, and individuals and companies would have more money. The more money a company had, the more the company would spend on new jobs, expansion, and increases in salaries. The money would trickle down to those who needed it.

Reagan’s cuts to social programs, such as health care and unemployment, mostly affected the poor. Business owners did not increase the number of workers or salaries. President Reagan’s theory did not lower the debt.

Americans still believe limited government intervention is important to the success of the economy of the United States. So, although there are social programs, they are not of the same quality as those in other industrialized countries.

The United Nations ranks countries according to their standard of living. Some criteria include health care, nutrition, secure livelihoods, security against crime and physical violence, and political and cultural freedoms.

Antitrust law: regulates the concentration of economic power to prevent companies from price colluding or creating monopolies.

Boom: a period of increased commercial activity within either a business, market, industry, or economy as a whole.

Bust: a period during which economic growth decreases rapidly. During this time, inflation decreases, and in extreme cases, can give way to deflation. In addition, unemployment rises, income falls, and aggregate demand decreases.

Invisible hand: in economics, the concept that individual self-interest and competition would regulate the economy.

Laissez-faire: an economic theory or system that advocates little or no government interference in the economic affairs of the people.

Monopoly: exclusive possession or control of the supply of or trade in a commodity or service

New deal: a series of economic measures introduced by US President Franklin D. Roosevelt during the Great Depression (1929 through the 1930s) which increased the role of the US government in the economy

Recession: a significant decline in economic activity that is spread across the economy and that lasts more than a few months

Supply and demand: the balance between items produced and items purchased

In this lesson, you explored the following question: How have market economies embraced liberalism?

The economy of the United States has experienced a shift in practice from the days of laissez-faire capitalism to the interventionist ideas of Roosevelt’s New Deal. The government of the United States has adopted a more modern liberal approach to solving economic issues facing Americans.

Economic instability, as demonstrated in the economic cycle, has become a challenge to the American government. The government has had to determine what actions it will take to limit the boom and bust extremes of the cycle. Roosevelt maintained the values of a market economy and adopted social programs to help individuals in times of need.

Many of the policies adopted by Roosevelt have continued to influence the economy of the United States. Modern liberal practices have proven to be an asset to modern liberal economies.

In the next lesson, you will continue to address the question: How have economic systems embraced liberal ideology?

From the perspective of a laissez-faire economist, which of the following headlines identifies the most acceptable method of easing an economic problem? Explain.